Knowledge-Based Guidance

Finally, Annuity Advice That Feels Human

No jargon. No gotchas. Just honest, personalized annuity guidance from someone who truly cares.

Book Your Strategy Session

Get an Annuity Quote

Get a Second Opinion

Information provided by AnnuityRateWatch.com. Rates are the current guaranteed rates as of the date listed, and are subject to change without notice at the discretion of the issuing company.

MYGA Fixed-Rate Annuities

Today's Rates Up To

3 years

5.65%

5 years

5.80%

7 years

5.80%

10 years

5.75%

Straight Talk on Annuities

Confused by annuity options, technical jargon, and pushy sales tactics? You're not alone.

Whether you’re ready to purchase an annuity, seeking a second opinion, or looking for honest answers to pressing questions, we’ll help you grasp exactly how each annuity may impact your income, taxes, and growth—always explained in straightforward, plain English.

Fixed Annuity Benefits

Putting More Than Money In Your Pocket

Whether it’s more time with grandkids, more trips on the calendar, or worry-free relaxation, annuities can help you to live more—on your terms.

Benefit 1

Principal Protection—Zero Exposure to Market Losses

Take the grandkids on a dream vacation without worrying about market dips.

Benefit 2

Opportunities to Help Offset Long-Term Care Expenses

(may involve an additional annual fee)

Enjoy pottery class or morning yoga, free from the stress of future care costs.

Benefit 3

Help Safeguard Your Legacy & Income for Loved Ones

Help protect your grandchildren’s college tuition and protect the family home.

Types of Annuities

Helping You Know Before You Sign

MYGA, FIA, GLWB riders—when it comes to selecting the right annuity, there’s a lot to understand. That’s why we’ve broken each annuity type into plain English summaries designed to build your knowledge and help you make the right decision for your retirement.

Fixed Index Annuities**

Opportunity to earn interest tied to an external market index (limited by the issuing company, while your principal stays 100% protected in down years—no losses, only growth potential.

Variable Annuities*

Invest in stock-and-bond sub-accounts for unlimited upside potential, with optional riders that can add lifetime income or downside buffers for a fee. Involves market risk, including possible loss of principal.

Immediate Annuities**

SPIAs

Turn a lump sum into a steady income stream that typically starts within 30 days and can last as long as you—or you and a spouse—do.

Deferred Annuities**

Grow tax-deferred now and may be converted to guaranteed income later, letting you control when you tap your retirement income.

QLAC**

Help reduce RMDs now and secure guaranteed lifetime income later, helping you minimize taxes and protect your savings from running out.

*Before investing, investors should carefully consider the investment objectives, risks, charges, and expenses of the variable annuity and its underlying investment options. The current contract prospectus and underlying fund prospectuses, which are contained in the same document, provide this and other important information. Please contact your financial professional or the Company to obtain the prospectuses. Please read the prospectuses carefully before investing or sending money.

**Annuities contain limitations including withdrawal charges, fees and a market value adjustment which may affect contract values.

Annuities are products of the insurance industry; guarantees are backed by the claims-paying ability of the issuing company and for variable annuities, do not apply to the performance of the variable subaccounts which will fluctuate with market conditions. Guaranteed lifetime income available through annuitization or the purchase of an optional lifetime income rider, a benefit for which an annual premium is charged. Annuity withdrawals are subject to ordinary income taxes, including a potential 10% IRS penalty if taken before age 59-1/2. Optional riders may involve an additional annual fee, and include restrictions and limitations. LTC riders are NOT a replacement for long term care insurance. Product and feature availability may vary by state.

Investment advisory services are provided in accordance with a fiduciary duty of care and loyalty that includes putting your interests first and disclosing conflicts. Insurance services have a best interest standard which requires recommendations to be in your best interest. Advisors may receive commission for the sale of insurance and annuity products.

Meet Eric Judy

By-the-Numbers Analysis, From-the-Heart Approach

As the founder of Annuity Guys, Eric Judy has one goal: deliver the knowledge, guidance and in-depth analysis clients like you need to find the right annuity for their unique goals—and then go live the life they’ve worked so hard to make a reality.

One-Click Library

Annuity Answers at Your Fingertips

Our on-demand resource hub includes dozens of in-depth videos and articles , all hand-crafted by our founder, Eric Judy, and always available at no cost.

Straight Talk on Annuities

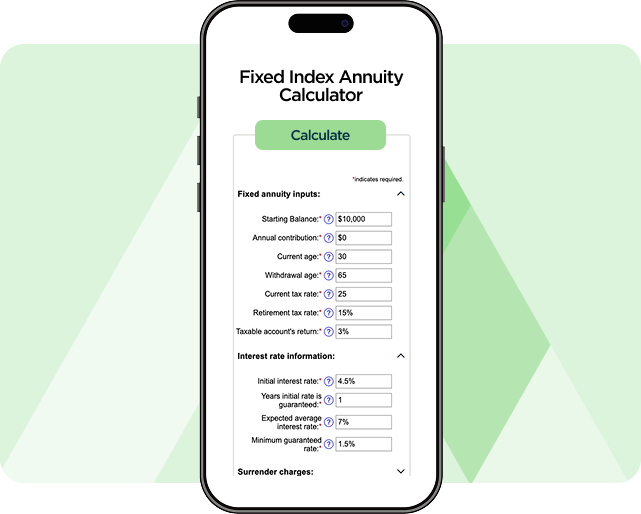

The Best Retirement Strategy is a Clear One

When it comes to helping our clients with annuities, we don’t do guesswork. And you shouldn’t either. Use our suite of calculators to make informed, confident decisions about your financial future.

Questions We Hear

Have Annuity Questions? We Have Annuity Answers

What is an annuity?

An annuity is a financial product offered by insurance companies that offers guaranteed, regular payments, usually for retirement. You purchase it by paying a lump sum or in a series of premium payments, and can receive steady income either now or later, depending on the type of annuity selected. Common types include fixed, variable, fixed indexed, immediate, and deferred.

What types of annuities are there?

Main types are:

- Fixed Annuity: Guaranteed fixed interest rates.

- Variable Annuity: Returns depend on market performance and involve investment risk.

- Fixed Indexed Annuity: Potential interest is linked to a market index (e.g., S&P 500) and is limited by the issuing company, but with guarantees to principal.

- Immediate Annuity: Starts payments immediately after lump sum payment.

- Deferred Annuity: Payments start at a future date.

Are they safe? Is an annuity a good idea?

Annuities are backed by the financial strength and claims-paying ability of the issuing company, and are regulated by state insurance departments, who require annuity carriers to maintain certain levels of reserves to pay claims. However, their suitability depend on individual financial goals, risk tolerance, and careful evaluation of the insurer’s strength.

What are the fees?

Annuities may involve several fees, many of which are priced into the product itself. Some additional potential fees include:

- Commissions: Sales charges paid by the issuing company to the selling agent.

- Administrative fees: Management exenses.

- Surrender charges: Penalties for early withdrawals.

- Optional riders: Fees for additional guarantees or features.

These fees vary widely by issuing company and annuity type.

Start Today

Ready To Experience Annuity Guidance That Feels Human?

No pressure, no strings attached—just honest, unbiased guidance to help you confidently make the right decision for your retirement.

Connect with us today!

Book Your Strategy Session

Get an Annuity Quote

Get a Second Opinion